Are you planning an upcoming trip to West Virginia? Renting a car for your travel plans is often the most convenient and cost-effective way of getting around. But before you sign on the dotted line, it's important to understand rental car insurance in West Virginia. In this article, we’ll discuss everything you need to know about coverage types and requirements in West Virginia so that your road trips can be as worry-free as possible.

Are you planning an upcoming trip to West Virginia? Renting a car for your travel plans is often the most convenient and cost-effective way of getting around. But before you sign on the dotted line, it's important to understand rental car insurance in West Virginia. In this article, we’ll discuss everything you need to know about coverage types and requirements in West Virginia so that your road trips can be as worry-free as possible.

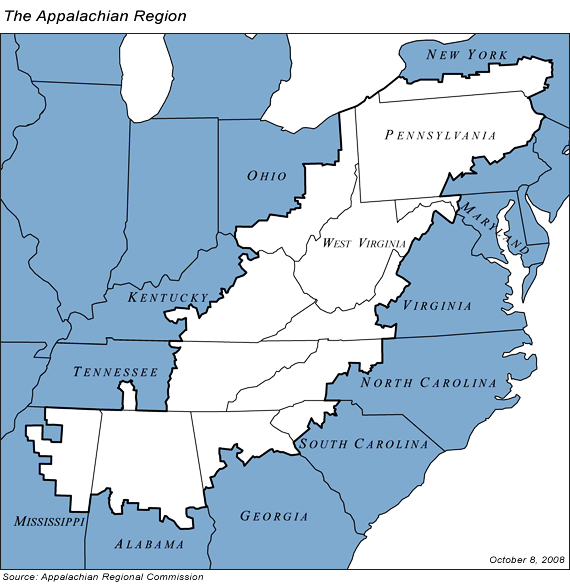

The state of West Virginia is in Southern / Mid-Atlantic United States. WV also forms part of the Appalachia cultural region in the Eastern US (see map below). Renowned for great outdoor adventure with magnificent scenery, visiting West Virginia is a brilliant choice. From rafting its world-acclaimed whitewater, staying at luxury resorts and visiting mountain towns with their unique brand of arts and culture, the experience is breathtaking.

Image Title: Appalachian Region of the United States; Author: Jax42; Attribution: This work is in the public domain in the United States by virtue of government ownership

Minimum Requirements for Rental Car Insurance in West Virginia

West Virginia has a Compulsory Insurance Law that requires all registered vehicles to be insured and to carry proof of insurance at all times. This law extends to rental car companies, who need to provide liability insurance coverage to their customers. This coverage must meet the state's minimum requirements, which include $25,000 for bodily injury or death of one person, $50,000 for bodily injury or death of two or more people, and $25,000 for property damage. It's important to note that this coverage only applies to damages or injuries you may cause to others while driving the rental car, and does not cover damages to the rental car itself.

You should also be aware that West Virginia is a Fault State, which means that it uses a tort-based car insurance law. So if you get into a car accident and are found to be at fault, you’ll be responsible for paying for the expenses incurred by all the other parties involved. The most obvious expense is damage to other vehicles involved in the crash. Depending on the severity of the accident, this can range from minor scratches to major structural damage or even total losses.

In addition to vehicle repairs or replacement costs, there may also be medical bills for injuries sustained by any passengers involved in the accident. These expenses can quickly add up and become overwhelming for someone who isn't prepared for them. While your rental car supplier provides basic liability insurance, in most cases the minimum liability coverage is insufficient to cover all of the costs.

The Different Types of Coverage Offered for Rental Cars in West Virginia

Now that you know the minimum requirements for rental car insurance in West Virginia, you can easily identify the gaps in your existing coverage. You know that your rental car will already come with the minimum liability coverage. However, you still won’t be covered for damage to your own rental car and your own - and your passengers’ - medical costs.

To make sure that you’re fully covered, here are some things you need to do and the types of coverage you should consider:

Check Your Personal Auto Insurance Policy for Rental Car Coverage

Before you even think of purchasing any additional rental car insurance in West Virginia, it's important to check your personal auto insurance policy. See if it already covers rental cars and what types of coverage are included. In most cases, your personal car insurance already includes rental car coverage but you should review the details to ensure that it meets your needs. For instance, you have to learn if it provides damage, liability, and personal accident coverage. You also need to check the policy limits to see if it’s sufficient not only to meet the minimum liability but possible costs should you get into an accident.

See If You’re Eligible for Credit Card Rental Car Coverage

If you don’t have personal car insurance, you might still have some form of coverage. Some credit cards offer rental car coverage as a perk, which can save you money and provide peace of mind while on the road. However, not all credit cards come with this benefit, and even if they do, there may be certain requirements or limitations.

To see if you are eligible for credit card rental car coverage, start by checking your credit card benefits guide or contacting your provider's customer service. Look for information on what type of coverage is included, such as collision damage, liability, or theft protection. You should also check the conditions for eligibility; some cards may require that the rental reservation is made with the card or that the driver's name matches that on the credit card.

Another important consideration is that credit cards mostly provide secondary coverage. This means their protection kicks in only after you’ve exhausted your primary coverage.

If you’ve done the checking and have determined that you’re not sufficiently covered, you may want to consider purchasing additional coverage from the rental car company or through a third-party provider.

Purchase Collision Damage Insurance

Collision damage insurance is designed to protect you from costly expenses that may arise as a result of an accident or collision while driving a rental car. This type of insurance can cover damages to the rental vehicle itself due to your involvement in an accident. Without it, you could be held personally liable for thousands of dollars in repairs.

Here, it’s important to note that collision damage insurance is not the same as the collision damage waiver from the rental company. The collision damage waiver (CDW) is an optional coverage offered by the rental company which waives your financial responsibility for damages to the rental car. This means that if anything happens to the vehicle during your rental period, you won't have to pay any out-of-pocket expenses for repairs or replacement.

Get Supplemental Liability

Supplemental Liability Insurance provides additional protection beyond the limits of the minimum coverage provided by the rental company or even your personal auto insurance. It typically covers damages or injuries you cause to others while driving the rental car, up to a certain amount. Without SLI, you could be responsible for paying out-of-pocket for any damages or injuries that exceed your personal policy limits.

Not only does SLI provide added financial security, but it also gives peace of mind while driving in unfamiliar territory. Accidents can happen anywhere and at any time, so having the proper coverage is essential for protecting yourself and others on the road.

Consider Additional Coverage Options for Rental Car Insurance

While rental car companies in West Virginia are required to provide liability insurance coverage, it may be worth considering additional coverage options to protect yourself and the rental car. A common option is Personal Accident Insurance or PAI. PAI provides coverage for medical expenses and accidental death or dismemberment.

Tips to Save When Renting a Vehicle in West Virginia

Obviously, the best way to ensure that you’re getting the best rental car insurance coverage at the lowest possible cost is to compare across different providers and their offers.

While many people focus solely on price when it comes to renting a car, remember to also consider other points such as the level of coverage and ease of claims. It’s also important to review the policy carefully and ask any questions before making a decision on additional coverage. Understanding your options and requirements can help you make an informed decision and ensure you have the coverage you need while on the road.

If you’re renting for an extended period of time (longer than 21 days), try negotiating for a long-term rates as this could bring an even better value. Keep these tips in mind when searching for car rental rentals in West Virginia so that you can save money while still keeping yourself protected against any incidents while on the road.

Aside from rental car insurance, here are some general tips on renting a vehicle that will save you some money:

Rental Cars from an Airport

Collecting your rental wheels at an airport invariably involves costly airport surcharges. Avoiding these unwanted add-ons is as simple as choosing a car rental service away from the airport. Most in-town rental offices provide transportation to and from the airport. No more queues or crowds at the airport rental counter!

Unlimited Mileage

If you plan to drive long distances, check the mileage caps if there are any. Most rental car companies offer the option of unlimited miles for the car rental period at a slightly higher daily rental fee. Choosing this option allows you to drive the car as much as you want without fearing the end-game charges.

Never Rush the Inspection

Thoroughly inspect your rental vehicle before you drive off. If you miss something you will likely face charges for damage you did not even cause. Damages like scratches or dents in the body or spills, stains or tears in the interior can go undetected. If you spot any defect, damage, tear or wear during the inspection, make a note on the car checklist or RA. It is not a good idea to assume the damage is too small to mention - the rental car company will definitely notice when you return the vehicle!

Remember Your Car Rental Insurance in West Virginia for Scenic Country Road Drives

If you find yourself needing to take a scenic drive through West Virginia's countryside, remember to pack not only your camera and snacks but also your car rental insurance. Car rental insurance isn't only mandatory in West Virginia; It can save you from financial burdens in case of an accident. Whether you’re planning a short or longer trip that requires driving unfamiliar routes, investing in car rental insurance is a wise decision.

If you do not own an auto policy or you're concerned about potential premium increases should you need to file a claim against your auto policy, then Bonzah's Affordable Car Rental Damage Insurance is for you. For a mere $7.99 a day, you get up to $35,000 cover while exploring the roads of West Virginia. This is available online at Bonzah.com. It is easy to understand, and the application process takes just a few moments of your time to collect your personal and payment details. Then we email the policy to you. No fuss, no bother, with peace of mind assured for the duration of your rental hire.